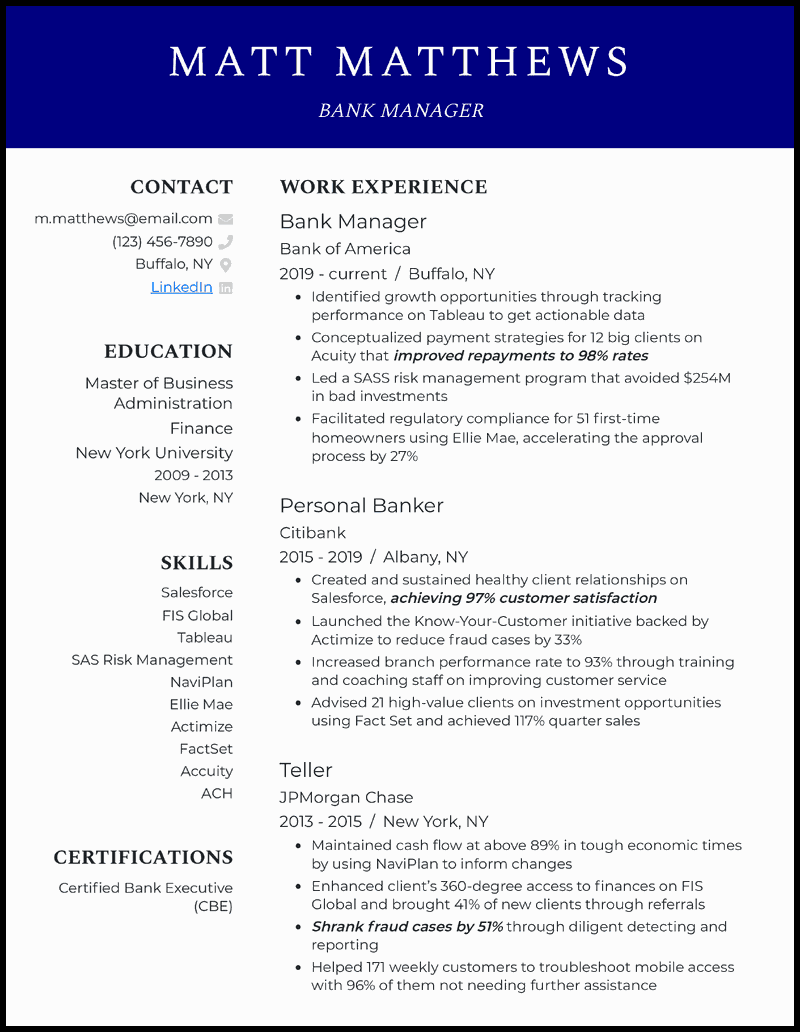

Looking for one of the best resume templates? Your accomplishments are sure to stand out with these bold lines and distinct resume sections.

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

Whether you’re an entry-level bank teller or you’ve climbed the ladder to being a manager, working in banking requires that you know your stuff. Thanks to your in-depth knowledge of the financial landscape, interpersonal skills, and keen eye for numbers, your bank’s customers walk away happy after each visit.

With various legal regulations, keeping up to date with the latest banking software, and studying new products, you’ve got your hands full on a daily basis. However, you’ll need to find the time to create an effective resume to advance your career.

That’s where we come in. Our AI cover letter generator, banking resume examples and handy resume tips helped hundreds of banking professionals land their next jobs, and now, it’s your turn!

The key to crafting an irresistible application is to match the job description as closely as you can.

For instance, if you’re applying for a senior bank teller role, include a good mix of skills that point to your banking proficiency as well as a couple of your interpersonal abilities. That includes things like conflict resolution and cross-selling, but also knowledge of anti-fraudulent measures and Oracle Flexcube.

In any case, try to check some of the most important boxes in the job listing. Keep things specific—instead of a vague “team player,” use more descriptive skills like “relationship building.”

Want some inspiration?

![]()

You’re no stranger to various kinds of data, be it financial figures or customer satisfaction metrics. Data will be your best friend as you work on this part of your resume and discuss your greatest achievements.

Refrain from simply listing off every single task from your past jobs—instead, frame your work as accomplishments and back it up with metrics.

In banking, money speaks volumes. Talk about the types of client accounts you’ve handled, investments you’ve guided, or branch budgets you’ve handled. There are many equally useful metrics, from reducing customer complaints to lowering the average wait times at your branch.

See what we mean?

Unless your career spans over 10 years, we recommend sticking to a one-page resume. Much the way customers only skim the contracts they sometimes sign, recruiters only spend a few seconds scanning your resume, so it’s best to keep it short and sweet.

Should I include a career summary or objective?A resume summary or objective can be an effective way to quickly highlight a career-defining achievement or describe why you’re the right fit for this particular banking job. Use it to mention a couple of key skills, such as your risk management, and include the name of the company you’re applying to.

Should I add any soft skills?You can, but it’s better to show them through your work experience bullet points. If you do add some, make them relevant to the job—for instance, employee engagement for a bank manager position.